Market recessions can be a scary time for many, especially when it feels like the economy is on shaky ground. But don’t worry, I’m here to guide you through some of the best strategies to help you stay afloat and even thrive during these times. We’ll also dive into what to do if a market downturn turns into a full-blown recession. Let’s jump in.

Related Videos: Odyssey – Rumble – Youtube

The Importance of a Recession-Ready Mindset

First things first, having the right mindset is crucial. Recessions can create uncertainty, but they also open up opportunities for those who are prepared. It’s essential to remain calm and focused on long-term goals rather than getting bogged down in short-term market fluctuations.

Strategy 1: Build a Solid Emergency Fund

An emergency fund is like a safety net for your finances. Ideally, you should aim to have three to six months’ worth of living expenses set aside. This fund will give you peace of mind and a buffer to fall back on if times get tough.

Why It Matters

If a market downturn causes you to lose your job or face reduced income, having an emergency fund allows you to continue paying bills and meet financial obligations without panicking.

How to Build It

Start small if needed, but be consistent. Set aside a portion of your income each month, and automate the process if possible. You might also consider using a high-yield savings account to grow your fund a little faster.

Strategy 2: Diversify Your Investments

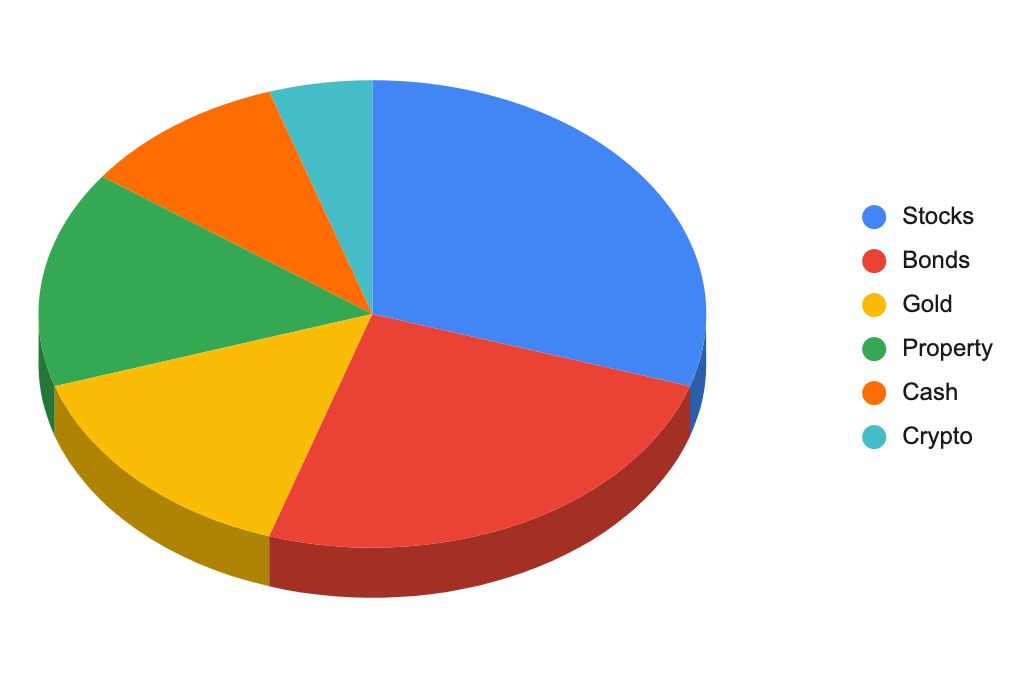

Diversification is like having a well-rounded team. If one player is down, others can step up. In investment terms, this means spreading your money across various asset classes, such as stocks, bonds, real estate, and commodities.

The Power of Diversification

Diversification reduces risk because it limits your exposure to any single asset. If one area of the market takes a hit, others might remain stable or even grow, helping you balance out losses.

Tips for Diversifying

- Stocks: Spread your investments across different sectors and industries.

- Bonds: Consider a mix of government and corporate bonds with varying maturities.

- Real Estate: Real estate investment trusts (REITs) offer exposure to property markets without requiring direct property ownership.

Strategy 3: Keep Your Debt in Check

Debt can be a major burden during a recession, especially if you’re dealing with high-interest rates. To stay on solid ground, aim to reduce or eliminate high-interest debt like credit cards and personal loans.

Debt Management Tips

- Consolidate: Look into debt consolidation to reduce interest rates.

- Pay More Than the Minimum: If you can, pay more than the minimum amount due to reduce the principal faster.

- Avoid New Debt: Refrain from taking on new debt unless absolutely necessary.

Strategy 4: Invest in Yourself

A market recession is a great time to invest in your skills and knowledge. Consider taking courses, earning certifications, or pursuing further education. The more you know, the more opportunities you’ll have, even in a challenging market.

Skill Development Ideas

- Online Courses: Platforms like Coursera and Udemy offer a wide range of courses.

- Certifications: Look for industry-specific certifications that can boost your career.

- Networking: Connect with industry peers to learn from their experiences and gain insights into emerging trends.

What to Do if a Market Recession Turns into a Full-Blown Recession

A full-blown recession might require additional adjustments. Here’s what you can do to weather the storm:

Revisit Your Budget

If the recession deepens, it’s time to get serious about budgeting. Cut non-essential expenses and focus on necessities. Consider cooking at home, canceling unused subscriptions, and finding cost-effective entertainment options.

Focus on Job Security

During a recession, job security is paramount. Look for ways to make yourself indispensable at work. Take on extra responsibilities, show flexibility, and be a team player.

Explore Side Hustles

A side hustle can provide additional income and serve as a backup plan if your primary job is at risk. Think about your skills and hobbies to find a side gig that suits you. Whether it’s freelancing, tutoring, or selling handmade crafts, every little bit helps.

Stay Informed but Avoid Panic

While it’s important to stay informed about economic developments, don’t get overwhelmed by negative news. Stick to reputable sources and limit your exposure to doom-and-gloom headlines. Focus on the things you can control, like your budget and career.

Conclusion

Market recessions are a natural part of the economic cycle, and while they can be challenging, they also present opportunities for those who are prepared. By following these strategies and adapting to changing circumstances, you can navigate a recession with confidence and come out stronger on the other side.

What are your go-to strategies for recession-proofing your finances? Share them in the comments below, and let’s keep the conversation going. For more in-depth look at trading in a recession check out this guide that goes into a little more depth

Market recessions: Best Strategies

Check out some of our sponsors

Link to a Course on Stock Trading