There’s a saying in the world of finance: “The only thing certain about the stock market is its uncertainty.” If you’ve ever watched the news and seen the stock tickers flashing red, or felt your stomach drop when you heard the word “recession,” you know what I mean. It’s like riding a rollercoaster where you can’t see the track ahead—exciting for some, but terrifying for others. But here’s the thing: just because the market dips doesn’t mean you have to as well. Many of the most successful traders have navigated recessions with finesse, and with great volatility comes great potential for profit. Its not only about reducing downside risk but also about positioning yourself the best to take advantage of the pivot when the recession turns to growth. We’re about to dive into the best trading strategies in a recession and also find new ways to thrive.

Diversification – The Safety Net

Picture a trapeze artist at the circus. As they soar through the air, they have complete confidence that the safety net below will catch them if they fall. That’s what diversification does for your investment portfolio—it’s your safety net.

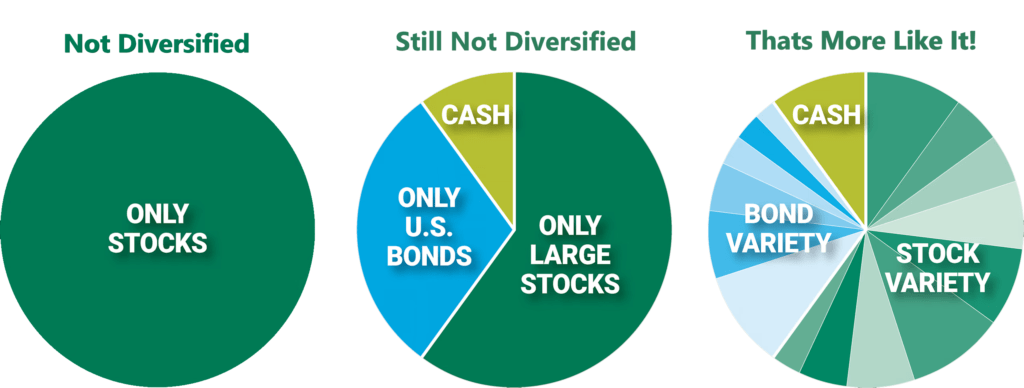

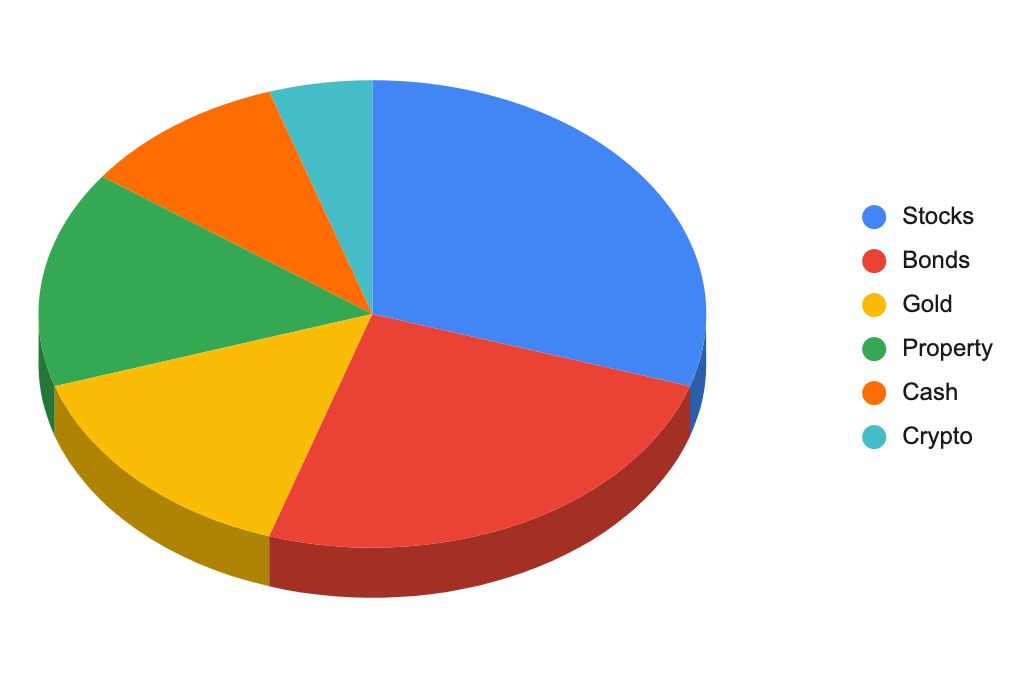

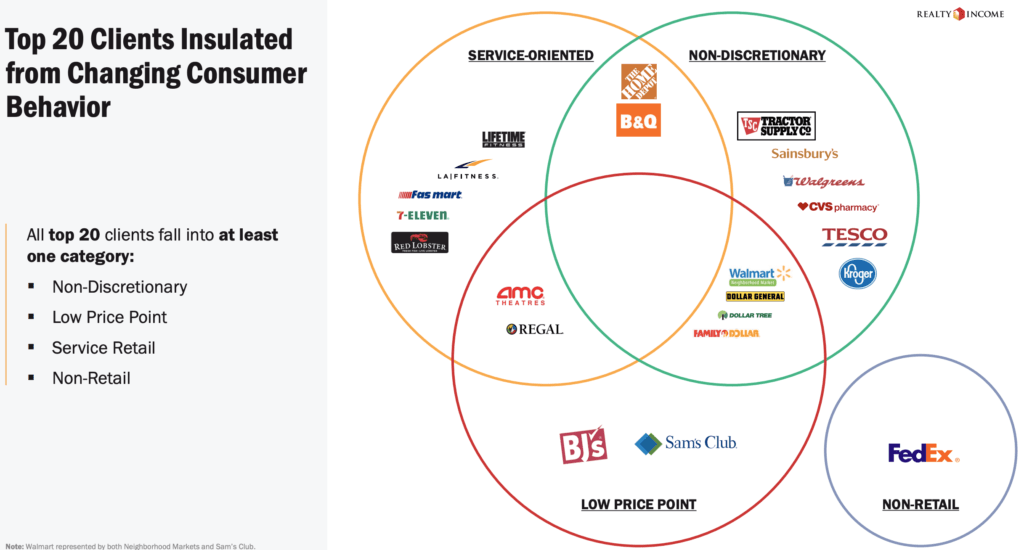

Diversification means spreading your investments across different asset classes, industries, and geographic regions to reduce risk. It’s a strategy that balances out the highs and lows, ensuring that if one area of the market takes a hit, others can keep you steady.

Think of it like a well-balanced meal. You wouldn’t eat just dessert for every meal, right? (Although that might sound tempting!) Instead, you balance your plate with proteins, vegetables, and carbs, ensuring you get all the nutrients you need. Diversification works the same way, allowing you to build a resilient portfolio that can weather a recession.

When it comes to diversification, there are a few key areas to focus on:

- Asset Classes: Spread your investments across stocks, bonds, real estate, and commodities. This way, if one class is underperforming, others might be doing well.

- Industries: Don’t put all your eggs in one industry’s basket. If tech stocks are struggling, your investments in healthcare or utilities might be holding strong.

- Geographic Regions: Consider investing in international markets. Different regions experience recessions at different times, providing balance.

If you’re unsure where to start, take a look at some examples of successful diversification. Consider a case study of a portfolio that weathered the 2008 financial crisis. Those who diversified their assets across multiple classes and industries saw less volatility and were better positioned for the recovery. In 2008 these were typically spreading into hedge funds, US Treasuries and Gold to outperform the market and cover the stock dips and reduced bond yields.

In the end, diversification is about creating stability, just like that trapeze artist’s safety net. With a well-diversified portfolio, you can navigate the ups and downs of a market recession with more confidence and less anxiety. It’s a simple yet effective trading strategy in a recession that every trader should consider.

Defensive Stocks and Industries, Trading Strategies in a Recession

Imagine you’re in the middle of a storm at sea. While other boats are tossed around, there’s a sturdy old ship that seems to cut through the waves with ease. That ship represents defensive stocks—solid, reliable, and able to weather the rough waters of a market recession.

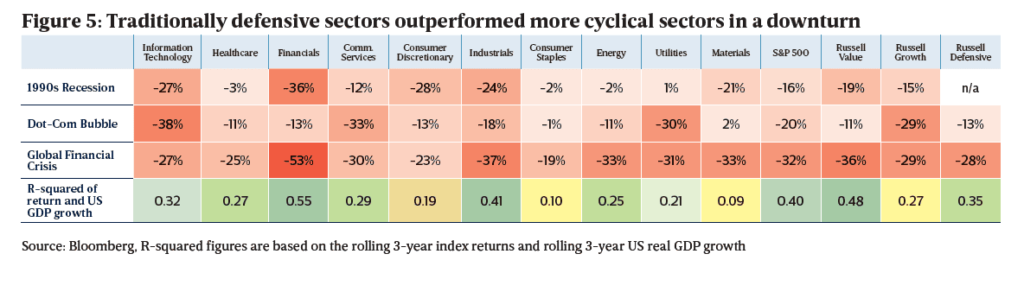

Defensive stocks are the unsung heroes of a portfolio, providing stability when the economy is shaky. These are companies that produce goods or services people will always need, like utilities, healthcare, and consumer staples. Even when people tighten their budgets, they still need electricity, medical care, and food on the table. This consistent demand makes defensive stocks a smart choice during a recession.

Here’s what you need to know about defensive stocks and industries:

- Characteristics of Defensive Stocks: These companies typically have steady dividends, low volatility, and a proven track record of resilience during economic downturns. They aren’t flashy, but they get the job done. Some CommonProctor and Gamble, Tyson Foods, Coca-Cola, Johnson and Johnson, Etc…

- Identifying Defensive Industries: Utilities, healthcare, and consumer staples are the big players. Think of companies that produce electricity, manufacture medicine, or sell household essentials. These industries tend to stay stable when others struggle.

- Benefits of Investing in Defensive Stocks: By incorporating defensive stocks into your portfolio, you’re adding a layer of security. They may not offer huge returns, but they can provide a consistent income stream and stability.

A real-life example helps bring this to life. During the 2008 financial crisis, many investors who held defensive stocks were able to mitigate their losses. Companies like Procter & Gamble, Johnson & Johnson, and Duke Energy showed resilience while other sectors crumbled. These examples highlight the importance of having a portion of your portfolio dedicated to these steady performers.

So, if you’re navigating a market recession and looking for trading strategies in a recession, remember that defensive stocks are like that sturdy ship in the storm. They keep you steady when everything else seems to be in turmoil. By focusing on these industries, you can create a portfolio that withstands the test of economic uncertainty.

Dollar-Cost Averaging: Steady Investment Approach

Picture this: you’re walking through a dense forest, unsure of what’s ahead. The path is rocky and unpredictable, with steep drops and sudden turns. Would you rather rush through, risking a fall, or take measured, consistent steps? Dollar-cost averaging is like that careful, steady approach, helping you navigate the market’s ups and downs with less stress and more control.

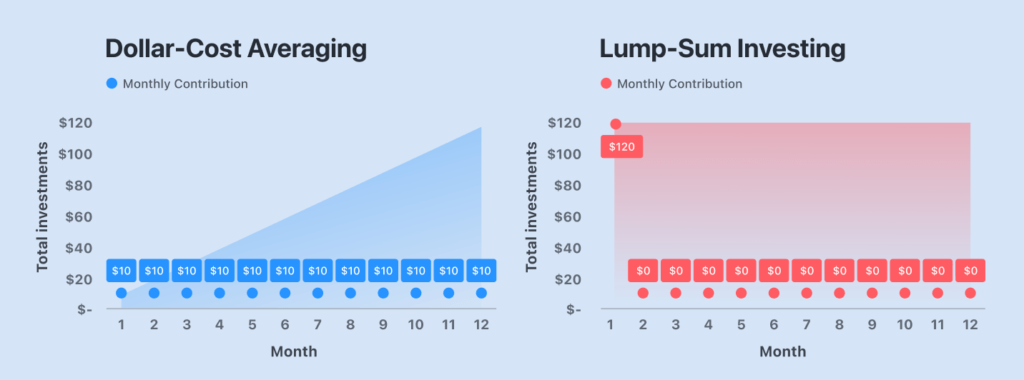

Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of the stock market’s performance. This approach reduces the impact of market volatility, as you’re buying more shares when prices are low and fewer when they’re high. This makes sure that your cost basis stays lower and that your portfolio’s performance gets to positive quicker, in a recession. It’s a smart strategy for those who want to invest during a recession without worrying about timing the market.

Here’s a deeper look into DCA and why it’s a solid strategy:

- Consistency in Investment: With DCA, you invest a set amount every week, month, or quarter. This regularity builds a habit of investing and reduces the temptation to time the market—a common pitfall for traders.

- Reduced Risk of Volatility: Because you’re investing at regular intervals, DCA spreads your investment across different market conditions. This reduces the risk of investing a large sum at a market peak, only to watch it lose value during a downturn.

- Best Practices for DCA: To get the most out of dollar-cost averaging, consider starting early and investing for the long term. This approach works best when you’re consistent and patient, allowing your investments to grow over time.

Think about investors who weathered the 2000 dot-com crash or the 2008 financial crisis. Those who practiced DCA came out ahead in the long run. They didn’t panic during market downturns because they understood that their consistent investment strategy would pay off in the end.

As you consider dollar-cost averaging, remember that it’s not about making quick profits—it’s about building a foundation for long-term success. Just like that steady walk through the forest, DCA helps you reach your destination safely, even when the path gets rocky. If you want the best trading strategies in a recession, DCA is a strategy worth exploring.

Hedging Strategies for Protection

Think of a hedging strategy as a well-placed safety harness on a rock-climbing expedition. It’s there to catch you if you slip, offering a measure of protection while allowing you to keep climbing higher. In the world of trading during a recession, hedging is your safety harness, designed to mitigate potential losses and give you the confidence to take calculated risks.

Hedging involves using financial instruments to offset potential losses in other parts of your portfolio. While it doesn’t guarantee you’ll never lose money, it does provide a cushion that can reduce the impact of market downturns. When you hedge you reduce your downside and in the long run that equates to an upside when the market turns back in your favor. Let’s explore how hedging works and why it can be an effective strategy during a recession.

Here’s what you should know about hedging:

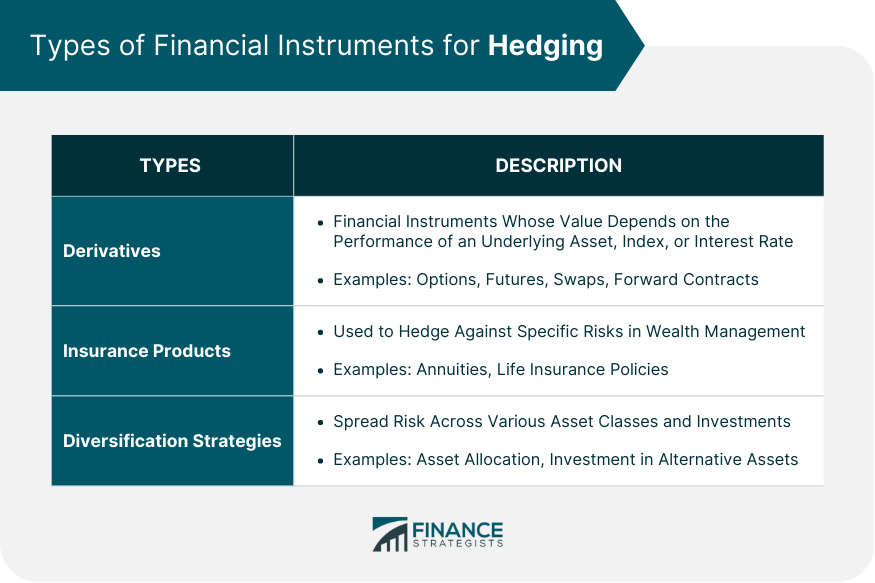

- Common Hedging Instruments: Hedging typically involves financial tools like options, futures, and inverse ETFs. These instruments allow you to bet against the market or lock in prices, offering protection if things go south.

- When Hedging is Useful: Hedging is most valuable when the market is particularly volatile or when you’re heavily invested in a specific asset class or sector. It helps balance risk and can be part of a broader risk management strategy.

- Benefits and Risks of Hedging: While hedging can provide protection, it’s not without risks. It can be complex, and if not used properly, it might lead to unexpected losses. It’s essential to understand the tools you’re using and the specific risks they carry.

For a real-world perspective, during the 2008 financial crisis, many traders who hedged with put options were able to protect their portfolios from steep declines. Hedge fund manager John Paulson reached fame during the credit crisis for a spectacular bet against the U.S. housing market. This timely bet made his firm, Paulson & Co., an estimated $20 billion during the crisis. He quickly switched gears in 2009 to bet on a subsequent recovery and established a multi-billion dollar position in Bank of America (BAC) as well as an approximately two million shares in Goldman Sachs. He also bet big on gold at the time and invested heavily in Citigroup (C), JP Morgan Chase (JPM), and a handful of other financial institutions. Paulson’s 2009 overall hedge fund returns protected his positions and when he pivoted he posted huge gains in the big banks in which he invested.

Ultimately, hedging is about providing a safety net. Just like a rock climber uses a harness to protect against falls, traders can use hedging to protect against market downturns. If you’re navigating a market recession, learning about hedging strategies could be the key to feeling secure while still pursuing growth.

Focus on Quality and Fundamentals

Imagine you’re building a house. Would you rather construct it on shaky ground or a solid foundation? Quality stocks are that solid foundation, providing stability and resilience during turbulent times. When you’re navigating a market recession, focusing on companies with strong fundamentals can be the key to keeping your portfolio upright when everything else is teetering.

Quality companies are those with a proven track record of consistent earnings, strong balance sheets, and reliable management. They might not offer the flash and hype of high-growth stocks, but they bring a level of dependability that’s invaluable during a recession. Here’s why you should focus on quality and fundamentals when trading during a downturn:

- Characteristics of Quality Companies: These companies tend to have stable revenue streams, lower debt, and a history of paying dividends. They’re often leaders in their industries, with a strong market presence and loyal customers.

- Evaluating a Company’s Fundamentals: To find quality companies, look at their financial statements. Check for solid cash flow, manageable debt, and consistent profitability. Analyze their business model and industry position to ensure they have a competitive advantage.

- Benefits of Investing in Quality Stocks: When a recession hits, quality stocks are more likely to hold their value. They might not experience the same rapid growth as speculative stocks, but they offer a safer harbor during storms.

A great way to illustrate the value of quality stocks is by examining a company’s performance during previous recessions. Companies like Johnson & Johnson, Procter & Gamble, and Coca-Cola are often cited as examples of businesses that maintain stability even when the market is in turmoil. These companies have strong fundamentals and a track record of resilience, making them attractive options during a recession.

Investing in quality and focusing on fundamentals is like building a house on solid ground. When the storms of a recession come, these companies are more likely to stand firm. If you’re looking for strategies to navigate a market recession, quality stocks should be a key component of your trading plan.

Conclusion for Trading Strategies in a Recession

Navigating a market recession can feel like steering a ship through a stormy sea. The waves are unpredictable, and the winds can change direction at any moment. But with the right trading strategies in a recession, you can keep your ship on course and even find opportunities amid the turmoil.

In this article, we’ve explored some of the best trading strategies to help you maintain stability and growth during a recession. By diversifying your portfolio, focusing on defensive stocks, adopting dollar-cost averaging, utilizing hedging strategies, and investing in quality companies with strong fundamentals, you’re building a robust foundation for weathering economic downturns.

As you consider your trading journey during a recession, remember that it’s not just about survival—it’s about finding ways to thrive. Some of the greatest success stories in trading come from those who saw opportunity where others saw chaos. The key is to stay informed, remain patient, and stick to your strategies.

If you’re inspired to take action, start by assessing your current portfolio. Are you diversified? Do you have exposure to defensive industries? Have you considered dollar-cost averaging or hedging? These questions can guide you as you navigate the challenging waters of a market recession.

Check out some of our sponsors

Hostinger – Web hosting for any thing from personal website to a cloud business

Link to a Course on Stock Trading