Are you worried about a recession? Is the stock market crashing around your ears? Before you start selling everything, let’s break down what an actual recession is and how it differs from a market crash. Welcome to High-Tech Redneck Money, where we help you navigate an ever-changing financial world. Now lets get into Recession vs. Market Crash.

Related Videos: Odyssey – Rumble – Youtube

What is a Recession?

A recession is a significant, widespread, and prolonged downturn in economic activity. According to Investopedia, a recession is defined by several key factors:

- Significant decline: There must be a noticeable drop in economic activity.

- Widespread impact: This decline affects various sectors across the economy.

- Prolonged period: The downturn lasts for an extended period, typically at least six months.

- Text-book Rule of Thumb: Two consecutive Real GDP reports of Negative Growth

Understanding a Market Crash

Often, media and analysts might use the terms “market crash” and “recession” interchangeably, but they are distinct events. A market crash is characterized by:

- Rapid decline: A steep drop in stock market prices, typically more than 20%.

- Immediate impact: This decline happens quickly and can cause panic among investors.

- Leading indicator: While a market crash is not the same as a recession, it often precedes one. If severe enough, it can trigger a broader economic downturn.

The Relationship Between Recession vs. Market Crash

Although a market crash can lead to a recession, the two are not synonymous. A market crash might be a signal that economic trouble is on the horizon, but it doesn’t always mean a recession will follow. For instance:

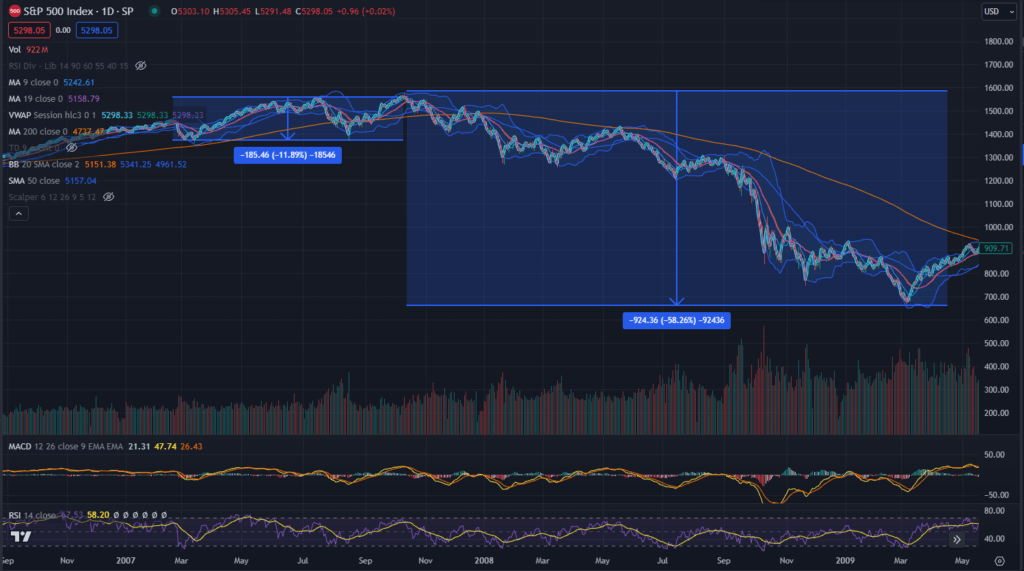

- 2007-2009 Financial Crisis: Before the recession, there was significant market volatility and instability in the GDP. The recession was officially declared only after GDP data showed two consecutive quarters of decline. This was reported around January of 2009 in the Q4 2008 report.

- Patterns in Charts: Analysts often look for patterns such as “M” shapes (indicating resistance and downturns) and “W” shapes (indicating support and upturns) in market charts to predict trends.

The Lagging Nature of Economic Data

One of the challenges in identifying a recession is the lagging nature of economic data. GDP reports, which are crucial for determining a recession, are only released quarterly. This means:

- Delayed recognition: By the time we have two consecutive quarters of negative GDP growth, we are already deep into a recession.

- Historical perspective: For example, the most recent GDP report may only show data up to Q1 of 2024, meaning any downturn starting in early 2024 won’t be officially recognized until mid-year.

Preparing for Economic Downturns

Whether or not we are heading into a recession, it’s essential to be prepared. Here are some strategies to consider:

- Diversification: Spread your investments across various asset classes to mitigate risk.

- Defensive assets: Identify and invest in traditionally defensive assets, such as utilities, healthcare, and consumer staples, which tend to perform better during economic downturns.

- Recession-ready mindset: Adopt a mindset that focuses on financial prudence and long-term planning. This includes building an emergency fund, reducing debt, and investing wisely. You can find the article linked at end to get more info on this as well as videos that go into more depth.

Conclusion

While predicting the exact timing of a recession or a market crash is challenging, understanding the differences between the two can help you make informed decisions. Keep an eye on economic indicators, diversify your investments, and stay informed to navigate the financial landscape effectively.

Thanks for Reading Recession vs Market Crash! For more tips and detailed guides on how to prepare for economic downturns, check out our other videos and articles. Remember to subscribe, ring the bell, and stay tuned for more updates. Whether we’re heading into a recession or not, being smart with your money always pays off.

Stay savvy, stay prepared, and keep navigating the ever-changing financial world with confidence.

If you want more on how to prepare for a recession checkout

If you would like to help out the website checkout these links to my Coloring books and Childrens books.

Or you can check out some channel partners affiliate links.

Amazon Books for Credit Repair

Link to a Course on Stock Trading

Visit our Partner BitIRA and Supercharge your IRA