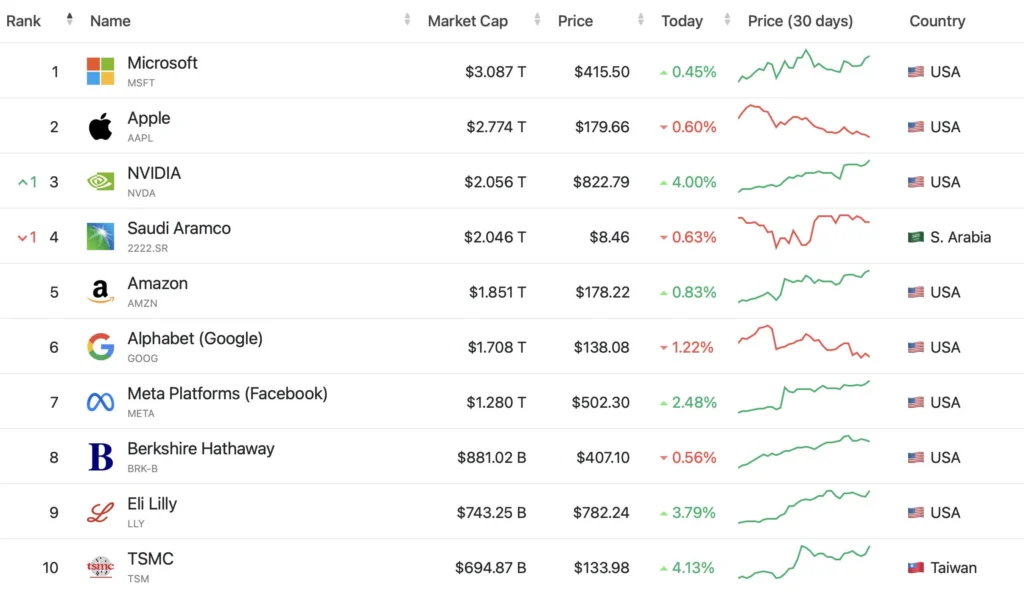

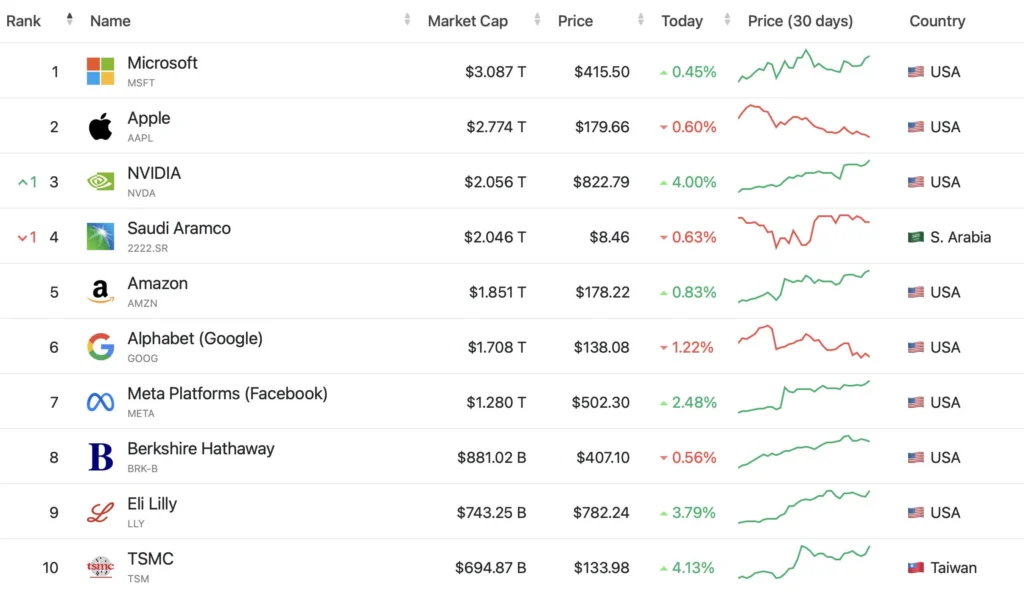

In the world of stock trading, knowing when to sell stocks is just as crucial as knowing what to buy. Whether you’re holding shares in tech giants like NVDA, GOOGL, META, AMZN, MSFT, AAPL, or TSLA, the decision to sell can be fraught with emotional and financial complexity. Drawing from seasoned market wisdom, here are expert strategies tailored to these leading companies, guiding you on when to sell stocks to maximize returns and minimize regrets.

- Recognize the Right Time: Accept Losses and Secure Profits

Understanding when to let go is key. Whether it’s a loss in AAPL or a gain in TSLA, the principle of cutting losses early and securing profits timely stands paramount. Accept that not all investments will pan out as expected, and be ready to act decisively to protect your portfolio. - Implement Profit-taking Strategies: The 20%-25% Rule

Stocks like NVDA and MSFT often demonstrate potential for significant growth. However, clinging to shares in hopes of indefinite gains can backfire. Implementing a profit-taking strategy, such as selling a portion of your holdings after a 20%-25% gain, can help balance greed and caution, locking in profits while still leaving room for potential growth. - Plan Your Exit Before Entering

Before investing in high-flying stocks like META or AMZN, have a clear exit strategy. Define your targets for taking profits and setting stop-loss limits. This proactive approach helps manage emotions, ensuring you’re not left making hasty decisions under pressure. - Protect Your Gains

Seeing a robust gain in GOOGL turn into a loss is more than frustrating; it’s a missed opportunity. If your stock has appreciated significantly, consider setting a trailing stop loss to protect your gains. This way, you can ensure that a sudden downturn doesn’t erase your hard-earned profits. - Detach Emotionally: Stocks Are Not Life Partners

Investing in companies like AAPL or TSLA can sometimes feel like entering a relationship. However, it’s crucial to remain emotionally detached and view each investment through a pragmatic lens. Be willing to sell when fundamentals or market conditions change, regardless of your affinity for the company. - Prioritize Selling Underperformers

Holding onto losers in hopes of a rebound is a common pitfall. Instead, focus on divesting underperforming stocks like a disappointing quarter in NVDA or a scandal-hit META. Reallocate these funds towards stocks with better prospects or existing winners in your portfolio. - Use Technical Analysis as a Selling Guide

Technical analysis becomes incredibly useful when deciding to sell. For instance, if AMZN’s stock price breaks below key support levels or moving averages, it may signal a time to sell. Monitoring chart patterns and volume can provide early warnings of a potential downturn. - Buy Right to Sell Right

Many investors regret their selling decisions because they bought at the wrong time or price. Ensure your buying decisions, whether in MSFT or GOOGL, are well-timed and based on solid market and company fundamentals. This foundation increases the likelihood of selling at a profit.

The decision of when to sell stocks like NVDA, GOOGL, META, AMZN, MSFT, AAPL, and TSLA hinges on a blend of strategy, discipline, and emotional detachment. By employing these expert strategies, you can navigate the complexities of the stock market more effectively, making informed decisions on when to sell stocks that protect your investments and maximize your returns. Remember, in the realm of investing, being informed and prepared is your greatest asset.