As we continue checking our warning lights lets take a look at what recession indicator we already looked at. The inverted yield curve tells us that trouble is on the way but we won’t know the timing till it reverts. We will continue on with the recession indicators, here is a recap of the seven though we will move on to the rest we haven’t talked about yet.

Related Videos: Odyssey – Youtube – Rumble

The Recession Indicators

Here’s what we’re going to continue looking at:

- Inverted Yield Curve: This happens when short-term interest rates are higher than long-term rates, a sign that investors are worried about the near future.

- Rising Unemployment: When more people are out of work, it often means companies are struggling.

- Declining Consumer Confidence: When people are less optimistic about the economy, they spend less, slowing down growth.

- Reduced Business Investment: Companies cut back on spending for new projects when they foresee tough times.

- Stock Market Volatility: Big swings in the stock market can reflect investor uncertainty.

- Falling Manufacturing Output: A drop in the production of goods can signal a decrease in demand.

- Decreased Housing Market Activity: Slower home sales and falling prices can indicate economic weakness.

Rising Unemployment: The Canary in the Coal Mine

Alright, let’s dive into the next warning light on our economic dashboard—rising unemployment. Imagine you’re running a business, and things start to slow down. What’s one of the first things companies do? Unfortunately, they often cut jobs. This leads to higher unemployment, which is a classic sign that the economy might be in trouble.

Rising unemployment is like the canary in the coal mine. It’s one of the earliest and most visible signs that all is not well. But here’s the tricky part: it usually creeps up slowly before accelerating during a recession. For example, in early 2023, the unemployment rate was around 3.4%. By late 2023, it had risen to 3.9%. This might not seem like a huge jump, but it’s enough to indicate that companies are starting to feel the pinch.

Unemployment tends to peak towards the end of a recession, so by the time we see significant rises, we might already be deep into one. For now, keep an eye on those job reports. If more and more people are losing their jobs, it’s a pretty strong signal that tough times are ahead.

Declining Consumer Confidence: The Mood Ring of the Economy

Next up, we’ve got declining consumer confidence. Think of consumer confidence as the economy’s mood ring. When people feel good about their financial situation, they spend more. This spending keeps businesses thriving and fuels economic growth. But when confidence drops, spending slows down, and the economy can start to stall.

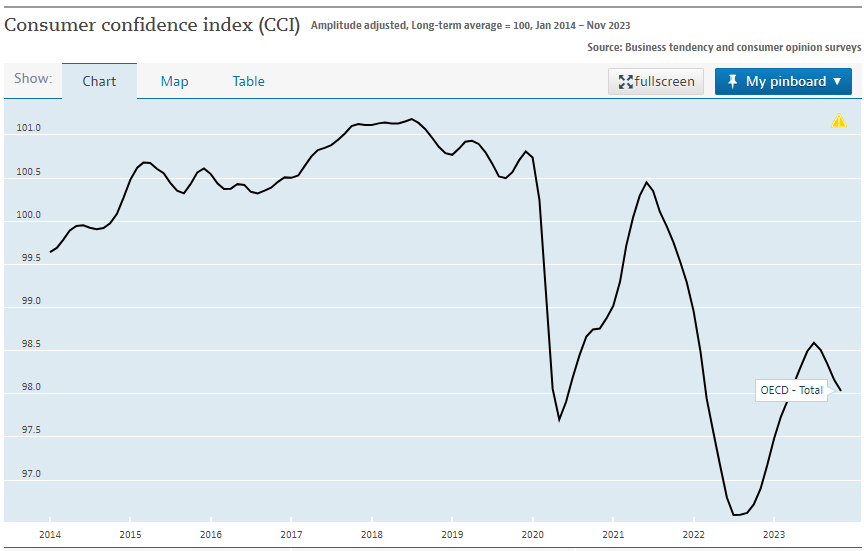

Consumer confidence is measured by the Consumer Confidence Index (CCI), which surveys how optimistic or pessimistic people are about the economy. Since the pandemic, consumer confidence has been on a rollercoaster ride. We saw a significant drop in late 2021, a brief recovery in mid-2022, and then another downturn. Factors like high inflation, rising interest rates, and increased layoffs have all played a role in this decline.

Let’s put it into perspective with a story: imagine you’re planning a big vacation. If you feel secure in your job and the economy looks stable, you’re likely to splurge on that dream trip. But if you’re worried about job security and rising costs, you might decide to stay home instead. Multiply this by millions of people making similar decisions, and you can see how a drop in consumer confidence can have a ripple effect throughout the economy.

As of now, consumer confidence is trending downward. People are tightening their belts, spending less, and this could lead to slower economic growth. Keep an eye on those confidence reports, because when people stop spending, the economy can quickly follow suit.

Reduced Business Investment: The Corporate Belt-Tightening

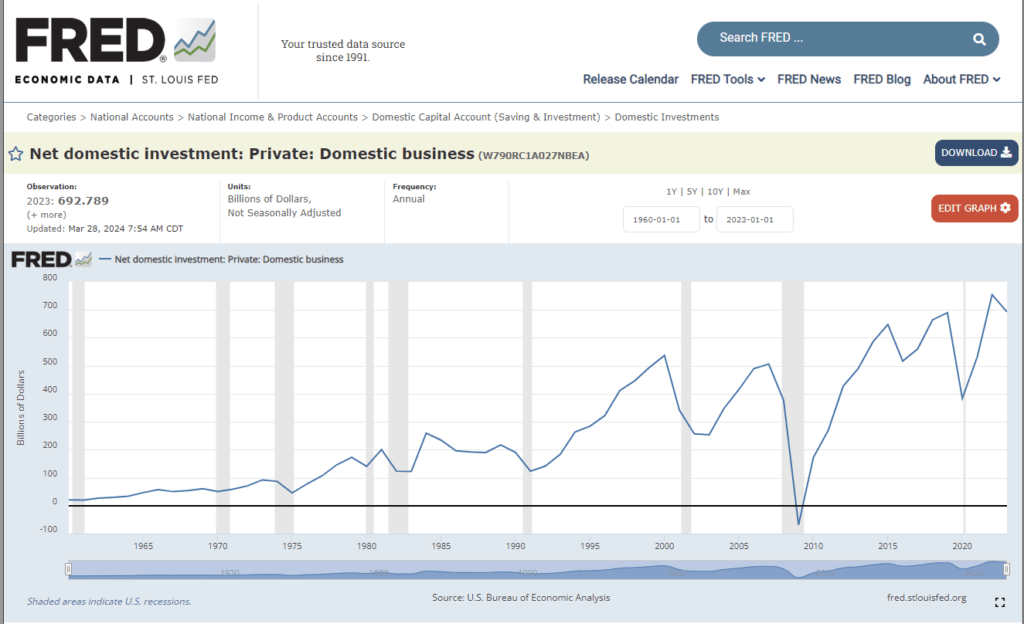

Moving on to reduced business investment. Imagine businesses as the engine of the economy. When times are good, companies invest in new projects, equipment, and expansion. This investment fuels growth, creates jobs, and keeps the economic machine running smoothly. But when companies start to worry about the future, they tend to hold back on spending.

We’ve seen a decline in business investment over the past year. Companies are sitting on cash instead of reinvesting it, which is a strong signal that they’re bracing for tough times. High interest rates and lower liquidity make borrowing more expensive, so businesses are playing it safe. For example, in 2022, net domestic investment for private businesses was around $754 billion. By 2023, it had dropped to $692 billion.

This belt-tightening can create a vicious cycle. Less investment means fewer new projects, which can lead to fewer jobs and slower economic growth. If businesses continue to hold back, it’s a clear sign that they’re expecting rough waters ahead.

The Stock Market Roller Coaster: Volatility as a Signal

Finally, let’s talk about stock market volatility. The stock market can be like a roller coaster—thrilling when it’s going up, but stomach-churning when it’s going down. Big swings in the market often reflect investor uncertainty and fear about the economic outlook.

Market volatility is measured by the VIX, often called the “fear index.” While the VIX itself is a lagging indicator, large swings in major indices like the S&P 500 can give us clues about investor sentiment. For instance, in recent months, we’ve seen the S&P 500 swing by more than 5% both up and down. This kind of volatility suggests that investors are nervous and uncertain about the future.

Volatility can be a self-fulfilling prophecy. When investors are jittery, they might sell off assets, leading to further declines and more panic. It’s like a feedback loop of fear. So, if you notice the stock market acting like a wild roller coaster, it’s a sign that all is not well in investor land.

Wrapping Up Our Recession Indicators.

We’ve covered a lot of ground on these recession indicators, from the eerie predictions of the inverted yield curve to the telltale signs of rising unemployment, declining consumer confidence, reduced business investment, and stock market volatility. Each of these indicators is like a piece of a puzzle, helping us see the bigger picture of the economic landscape.

Stay tuned as we continue to explore more indicators, like falling manufacturing output and decreased housing market activity. And remember, these warning lights are here to help us navigate the road ahead. By keeping an eye on them, we can make smarter financial decisions and stay prepared for whatever the economy throws our way.

Until next time, keep your seatbelt fastened and your eyes on the dashboard. We’ll get through this economic journey together!

Want to help support the site?

Amazon Author Profile here are some books I have for sale mostly children’s right now but more to come.

Need Web Hosting? Hostinger – Web hosting for any thing from personal website to a cloud business, Leverage powerful AI tools to build a professional website in minutes.