Hey there, fellow financial navigators! Welcome to Hi-Tek Rednek Money, where we help you steer through the ever-changing financial world. Today, we’re diving deep into a topic that’s on everyone’s mind: Is a recession on the horizon? Knowing these signs can help you prepare and stay ahead of the curve.

Related Video Odyssey – Rumble – Youtube

Why Should You Care About a Recession?

You might be thinking, “I don’t have any money in stocks right now, so why should I care?” Well, a recession impacts more than just the stock market. It affects the entire economy, including job security, the cost of living, housing prices, and even retirement savings. So, buckle up as we explore five key indicators that signal a potential recession.

1. The Yield Curve: A Reliable Predictor

Our first stop is the yield curve, specifically the inversion of the yield curve. The yield curve typically slopes upward, meaning long-term bonds have higher yields than short-term bonds. However, an inversion occurs when short-term bonds yield more than long-term bonds, signaling a lack of confidence in the economy’s future.

Key Takeaways:

- Longest Inversion in History: We are currently experiencing the longest yield curve inversion in history, surpassing the previous record of 624 days from 1978.

- Speculations: This inversion might last until the third quarter of this year. Although it’s uncharted territory, historically, an inverted yield curve has been a strong recession indicator. Typically the recession happens after this reverts.

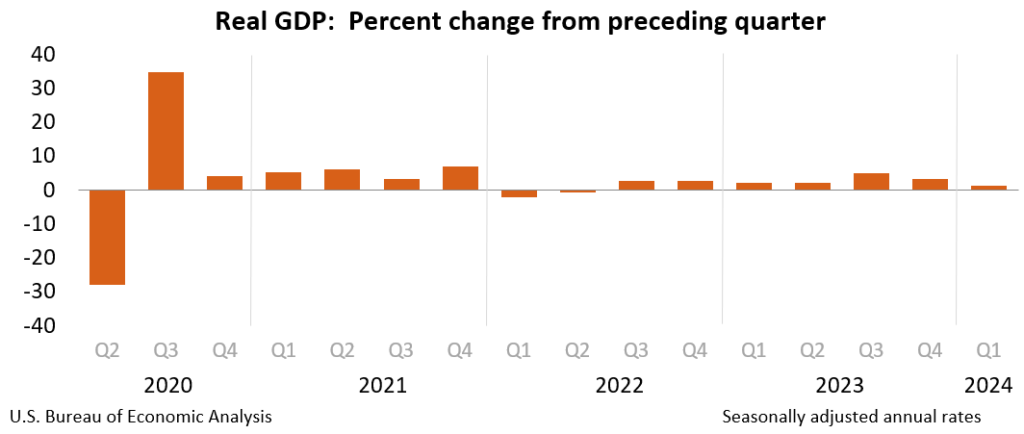

2. Real GDP Growth Rate: The Economy’s Health Meter

Next up is the real GDP growth rate, which measures the total value of goods and services produced in the country. When GDP growth slows or turns negative, it’s a red flag for the economy.

Key Takeaways:

- Downward Trend: Since Q3 of 2023, GDP growth has been trending down. Recent revisions have lowered growth estimates from 1.6% to 1.3%, with further revisions expected.

- Historical Patterns: Similar patterns were seen before the 2008 recession and the dot-com bubble burst in 2001.

3. Unemployment Rate: The Lagging Indicator

Our third indicator is the unemployment rate. It’s often a lagging indicator, meaning it peaks after a recession has started.

Key Takeaways:

- Rising Unemployment: The unemployment rate hit a previous high of 3.8% last year, dipped, and has now risen to 3.9%.

- Historical Context: Rising unemployment typically signals economic trouble ahead.

4. Consumer Confidence Index: The Public’s Mood

The Consumer Confidence Index (CCI) measures how optimistic or pessimistic consumers are about the economy’s prospects.

Key Takeaways:

- Current Low Levels: The CCI is currently at 98, a level not seen since the 2008 Great Recession.

- Downward Trend: Since the pandemic, the CCI has been in a downward channel, indicating growing consumer pessimism.

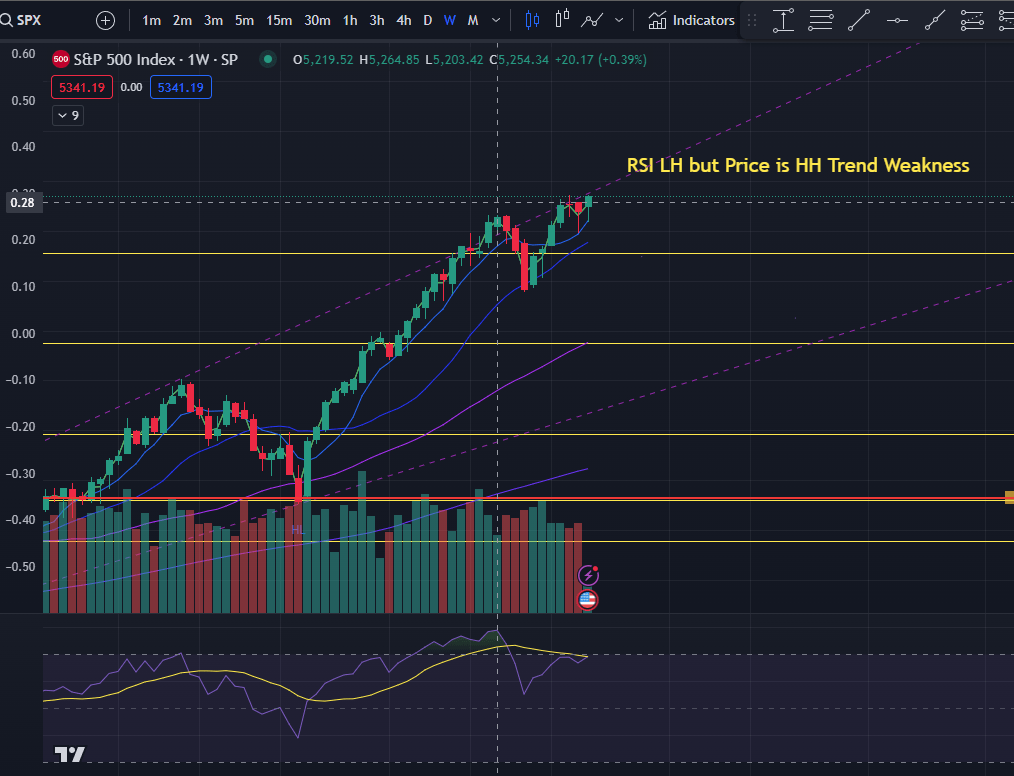

5. Stock Market Trends: A Double-Edged Sword

Finally, we look at stock market trends. While a booming stock market might seem like a good sign, it can also precede a downturn.

Key Takeaways:

- All-Time Highs with Weakness: The stock market is near all-time highs but shows signs of weakening momentum, which could indicate a looming downturn.

- Real Estate Trends: Existing and new home sales are trending down, similar to patterns seen before the 2008 recession.

Conclusion: What’s Next?

So, what does all this mean? While these indicators suggest a recession might be on the horizon, it’s essential to prepare. Here are a few steps you can take:

- Build an Emergency Fund: Aim for at least six months’ worth of expenses.

- Pay Off High-Interest Debt: This will give you more financial flexibility.

- Stay Informed: Keep an eye on these indicators and adjust your plans accordingly.

Stay tuned for more posts to help you navigate uncertain financial times and check out some of our guides on recession ready mindset and credit repair and building.

That’s it for today, folks! Thanks for joining me, and I’ll catch you in the next one. Stay safe and financially savvy!

Want to help support the site?

Amazon Author Profile here are some books I have for sale mostly children’s right now but more to come.

Need Web Hosting? Hostinger – Web hosting for any thing from personal website to a cloud business, Leverage powerful AI tools to build a professional website in minutes.