Hey there, welcome to High-Tech Redneck Money! Today, we’re diving deep into economic recession indicators to figure out whether a recession is on the horizon. Think of this like spotting warning lights on your car dashboard before it breaks down—only, in this case, it’s the economy we’re talking about.

Related Videos: Odyssey – Youtube – Rumble

What is a Recession?

Before we jump into the warning signs, let’s quickly revisit what a recession is. According to Investopedia, a recession is a significant, widespread, and prolonged downturn in economic activity. Typically, it’s marked by two consecutive quarters of negative GDP growth, but there are other factors like a noticeable drop in various sectors of the economy that last for at least six months to two years.

The Recession Indicators

Here’s what we’re going to be looking at:

- Inverted Yield Curve: This happens when short-term interest rates are higher than long-term rates, a sign that investors are worried about the near future.

- Rising Unemployment: When more people are out of work, it often means companies are struggling.

- Declining Consumer Confidence: When people are less optimistic about the economy, they spend less, slowing down growth.

- Reduced Business Investment: Companies cut back on spending for new projects when they foresee tough times.

- Stock Market Volatility: Big swings in the stock market can reflect investor uncertainty.

- Falling Manufacturing Output: A drop in the production of goods can signal a decrease in demand.

- Decreased Housing Market Activity: Slower home sales and falling prices can indicate economic weakness.

Inverted Yield Curve: The Crystal Ball of Economic Pessimism

Imagine driving your car and realizing that the rearview mirror is giving you clearer views than the windshield. Odd, right? In the financial world, this upside-down scenario is what we call an inverted yield curve.

Typically, long-term bonds should have higher yields than short-term bonds because investors demand more for the risks of time and inflation. But when short-term yields are higher, it’s like the market is saying, “I’m more worried about the near future.” This inverted yield curve has historically been a reliable predictor of recessions.

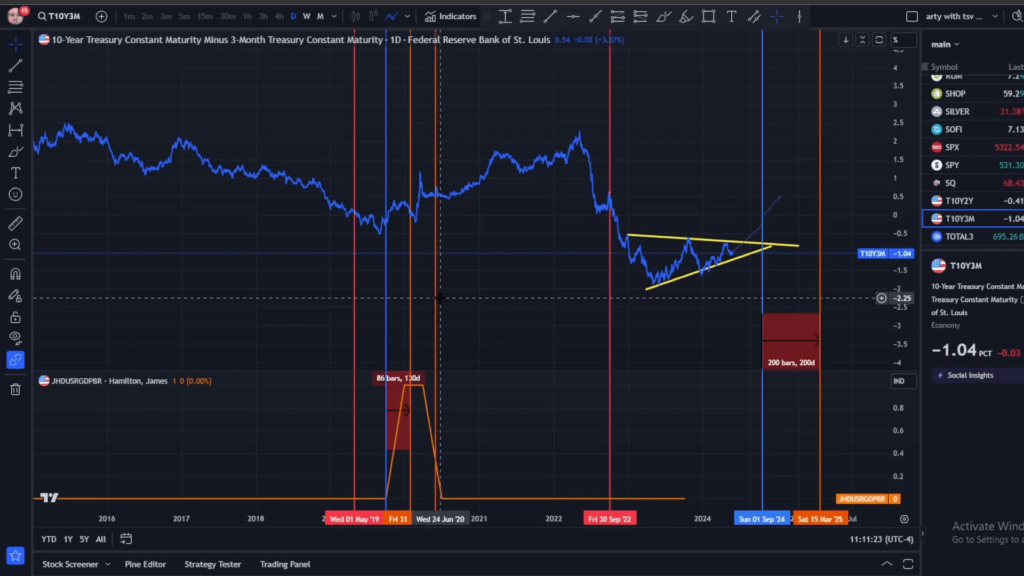

Let’s put on our detective hats and delve into some history. Back in 2019, the yield curve inverted, signaling trouble ahead. Sure enough, the economy went into a tailspin shortly after. It’s almost like the yield curve has a sixth sense for economic upheaval.

Current Scenario

As of now, the 10-year over 3-month treasury bonds have been inverted since late 2022, and the 10-year over 2-year bonds are also in similar territory. Historically, after the yield curve inverts and then reverts back to normal, a recession typically follows within 130 to 250 days. So, if we break the current inversion by mid-2024, we could be looking at a recession declaration by early 2025.

What’s Next for Recession Indicators?

Inverted yield curves are just the beginning. Next, we’ll explore the rising unemployment rates, declining consumer confidence, and other indicators. But for now, remember that these warning lights are like clues in a mystery novel—they point us towards the possibility of economic challenges ahead.

Stay tuned for more insights, and if you have any questions or want to dive deeper into another indicator, let me know! Until then, keep your financial dashboard in check and stay prepared.

Want to help support the site?

Amazon Author Profile here are some books I have for sale mostly children’s right now but more to come.

Need Web Hosting? Hostinger – Web hosting for any thing from personal website to a cloud business, Leverage powerful AI tools to build a professional website in minutes.