Banks and fintech companies are redefining the financial services landscape through innovative collaborations known as Banking as a Service (BaaS). As these partnerships continue to evolve, they promise to revolutionize the way financial services are delivered, offering greater convenience and accessibility for customers. This article explores the future of bank-fintech partnerships and provides key insights into Banking as a Service.

Support us Checkout my book on Amazon

The Evolution of Bank-Fintech Partnerships

Bank-fintech partnerships are not a new phenomenon. However, their structure and impact have significantly evolved over time.

In the early 2000s, fintech companies primarily served as disruptors, introducing specialized services like online payments and peer-to-peer lending. Many traditional banks viewed these newcomers as competitors rather than potential partners. But as the fintech industry matured, it became clear that collaboration—rather than competition—could deliver the most value to both parties and to customers.

Why Collaborate?

The motivations for banks and fintech firms to collaborate are multifaceted:

- Innovation: Fintech companies, thanks to their agile nature, are able to innovate rapidly. By partnering with them, banks can quickly adopt new technology and stay competitive.

- Customer Experience: With access to fintech innovations, banks can offer a more seamless and personalized customer experience.

- Regulatory Compliance: Banks, with their robust compliance frameworks, can help fintech companies navigate complex regulatory landscapes.

- Cost Efficiency: Partnering allows both banks and fintech firms to share resources and reduce operational costs.

Understanding Banking as a Service (BaaS)

Banking as a Service represents the pinnacle of bank-fintech collaboration. BaaS enables non-banking companies to offer financial services by leveraging a bank’s infrastructure. This model allows for the seamless integration of financial services into the customer experience of various industries, from retail to travel and beyond.

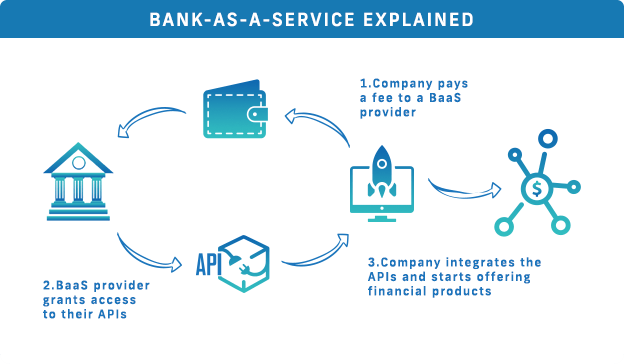

How BaaS Works

BaaS platforms provide a suite of financial products and services through APIs (Application Programming Interfaces). These APIs facilitate communication between different software components, enabling third-party companies to embed banking services into their own applications.

For instance, imagine a tech startup that wants to offer its users a proprietary digital wallet. Instead of building the banking infrastructure from scratch, the startup can employ BaaS. This way, they can deliver a fully functional digital wallet to their users efficiently and cost-effectively.

The Benefits of BaaS

The adoption of BaaS platforms offers several compelling advantages:

- Speed to Market: Companies can quickly offer financial products without the typical delays associated with building banking infrastructure.

- Cost Savings: Infrastructure and compliance costs are drastically reduced.

- Scalability: BaaS allows for easy scalability as companies grow, enabling them to add more services without extensive rebuilds.

- Enhanced Customer Experiences: Seamlessly integrated financial services can provide more cohesive and intuitive user experiences.

The Future of Bank-Fintech Partnerships

As financial technology continues to advance, the future of bank-fintech partnerships looks promising. Several trends are shaping this dynamic space:

1. Increased Regulatory Cooperation

As collaboration between banks and fintech firms intensifies, we can expect to see more proactive regulatory frameworks. Governments and regulatory bodies are likely to develop guidelines that encourage innovation while ensuring consumer protection and financial stability

2. Personalization and AI

The integration of Artificial Intelligence (AI) and Machine Learning (ML) in BaaS platforms will enable even greater personalization. Future bank-fintech partnerships will leverage big data analytics to offer tailored financial products and services that meet individual customer needs.

3. Expansion into New Markets

Emerging markets represent a massive opportunity for bank-fintech collaborations. As smartphone penetration continues to rise in these regions, fintech firms can partner with local banks to provide accessible financial services to underserved populations.

4. Ecosystem Building

The future will also see the construction of comprehensive financial ecosystems where various fintech products and services interconnect seamlessly. These ecosystems will enable users to manage all their financial needs in one place, from loans and investments to payments and insurance.

Support us Checkout my book on Amazon

Challenges to Overcome

While the potential benefits of BaaS are significant, there are challenges that must be addressed:

- Data Security: With increased digitalization comes the risk of cyber threats. Both banks and fintech firms must invest heavily in robust security frameworks to protect customer data.

- Regulatory Compliance: Navigating the complex web of financial regulations remains a considerable challenge. Maintaining compliance across different jurisdictions requires substantial resources and expertise.

- Technological Integration: Ensuring seamless integration between legacy banking systems and new fintech solutions can be technically demanding.

Case Studies: Successful Bank-Fintech Partnerships

To illustrate the transformative power of bank-fintech collaborations, let’s examine a couple of successful case studies.

1. Goldman Sachs and Apple: The Apple Card

Goldman Sachs partnered with Apple to introduce the Apple Card, a digital-first credit card that’s integrated into the iPhone’s Wallet app. By leveraging Goldman Sachs’ banking expertise and Apple’s technological prowess, they created a credit card that offers an unprecedented level of user experience and convenience.

2. BBVA and Simple: Simplifying Banking

BBVA, a Spanish multinational financial services company, acquired Simple, a U.S. digital banking firm. By integrating Simple’s technology with BBVA’s global banking infrastructure, they were able to provide a frictionless banking experience tailored to the digital age.

Wrapping it up!

In summary, the future of bank-fintech partnerships, encapsulated by the Banking as a Service model, promises to bring unprecedented innovations to the financial services sector. These collaborations offer numerous benefits, including faster time to market, cost savings, scalability, and enhanced customer experiences. However, overcoming challenges related to data security, regulatory compliance, and technological integration will be crucial for their sustained success.

As these partnerships continue to evolve, we can expect them to drive significant growth and transformation in the financial industry, ultimately redefining how we interact with financial services. Banks and fintech companies have a golden opportunity to shape the future of finance, heralding a new era of collaboration and innovation.

Support us Checkout my book on Amazon