Noob Trading Guide Introduction

In the fast-paced world of finance, trading strategies are the compass by which both novice and seasoned investors navigate. The quest for basic trading strategies spans a wide array of intentions, from the desire to secure a quick profit to the aim of building a stable, long-term investment portfolio. Understanding and applying these strategies effectively can significantly influence one’s success in the dynamic financial markets. This “Noob Trading Guide” sets the stage for an exploration into the foundational aspects of trading, the motivations driving different trading strategies, and a deep dive into common methodologies that have proven effective over time. With financial markets constantly evolving, the ability to adapt is key to success. Let’s dive into this “Noob Trading Guide”, designed to empower traders with the knowledge and tools needed to level up in the world of trading.

Videos Related to Guide

Youtube video on Risk Management

Youtube Video on Fibonacci Levels

Youtube Video on Ichimoku Cloud Indicator

Section 1: Foundations of Trading

1.1 Understanding the Basics in the Noob Trading Guide

At the heart of trading lie three fundamental concepts: assets, markets, and the act of trading itself. Assets can range from stocks and bonds to commodities and currencies, crypto and fiat, each offering unique opportunities and risks. Markets are the platforms or environments where assets are bought and sold, including stock exchanges and over-the-counter markets. Trading is the mechanism through which assets are exchanged, driven by strategies aimed at achieving profit or hedging against loss. Education plays a crucial role at all levels of trading, serving as the foundation upon which successful strategies are built.

1.2 Risk Management

The significance of risk management in trading cannot be overstated. Effective risk management strategies help traders minimize losses and protect gains. Key techniques include the use of stop-loss orders, which automatically sell an asset at a predetermined price to limit potential losses and portfolio diversification, spreading investments across various assets to reduce exposure to any single risk. These practices are essential for sustaining long-term success in trading.

Section 2: Motivations Behind Trading

2.1 Financial Goals

Trading strategies often reflect a trader’s financial goals, whether it’s income generation through day trading or capital preservation for retirement savings. Aligning one’s trading approach with specific objectives is crucial for developing a coherent and effective strategy. This alignment ensures that each trade contributes towards the overarching financial goals, providing direction and purpose to trading activities.

2.2 Adapting to Market Conditions

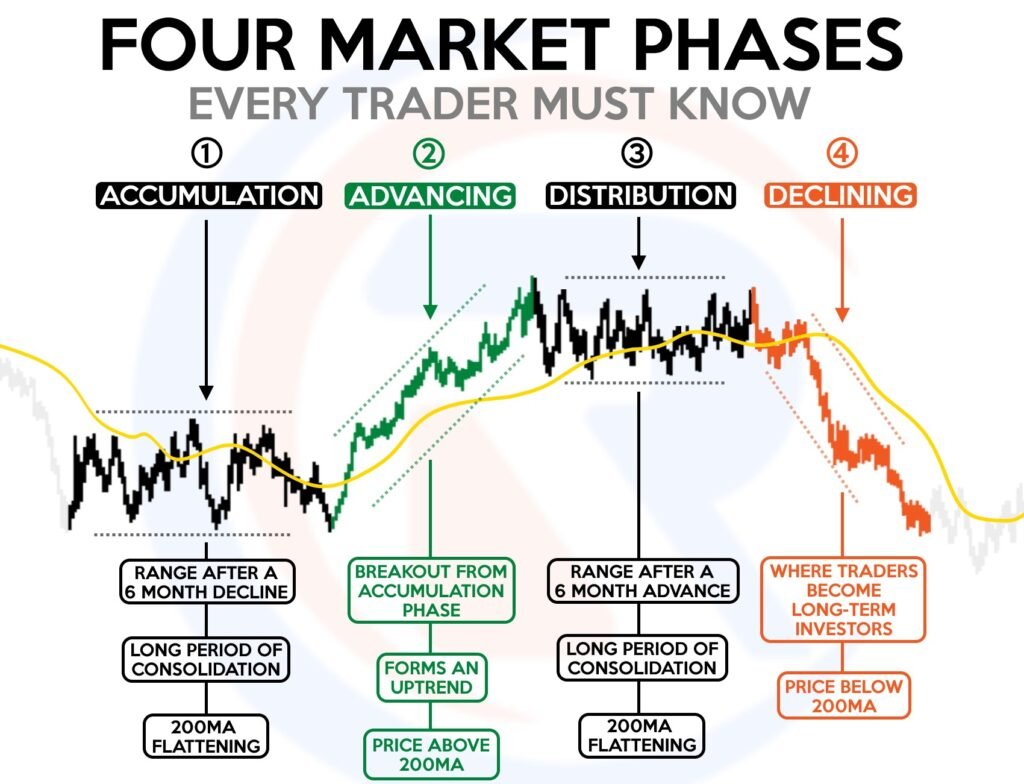

The ability to adapt strategies in response to market conditions is a hallmark of successful trading. Markets can be bullish (rising), bearish (falling), or move sideways, and each scenario requires a different approach. Recognizing and adjusting to these trends is critical for making informed trading decisions and maximizing opportunities across various market environments.

Section 3: Common Basic Trading Strategies

3.1 Trend Following

Trend following involves identifying and capitalizing on market momentum. Traders use indicators like moving averages to spot trends, buying assets in uptrends (above a moving average identified in the trading plan) and considering selling or short selling in downtrends (when the asset is below a certain moving average identified in the trading plan). This strategy relies on the belief that trends, once established, are likely to continue.

3.2 Swing Trading

Swing trading is designed for those looking to profit from short to medium-term price movements. It focuses on capturing gains in an asset over days to weeks. Identifying entry and exit points is crucial, often based on technical analysis or market patterns.

3.3 Convergence Strategies

Convergence strategies, such as the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI), aim to predict future price movements based on historical patterns when they align with other indicators such as a rise above or fall below a moving average. These strategies look for signs that an asset’s price will revert to its mean, offering opportunities for strategic entry and exit.

Section 4: Practical Application and Case Studies

4.1 Real-world Examples for Noob Trading Guide

Through case studies, traders can see how different strategies are applied in various market conditions. These examples provide valuable insights into the practical aspects of trading, illustrating how theories are transformed into actionable strategies. This is usually done by deciding on a strategy, looking at historical price data, seeing where a trade would fit that strategy, and what the outcome would have been to determine a strategy’s long-term viability.

4.2 Learning Through Experience

Mastering trading strategies requires more than just theoretical knowledge; practical experience plays a crucial role. Learning from both successes and failures helps traders refine their approaches, enhancing their ability to navigate the markets effectively.

Noob Trading Guide Conclusions

Altogether this noob training guide has explored the foundational elements of trading, the motivations behind different strategies, and an overview of common trading approaches. In the ever-evolving landscape of financial markets, continuous learning and adaptation are key to achieving and sustaining success. Remember, every trader’s journey is unique, and what works for one may not work for another. Embrace the process of discovery, remain committed to education, and stay adaptable to change. With determination and the right strategies, financial mastery is within reach. Happy trading!