In the oft-volatile world of economics, stability can be a welcome relief, and it appears that inflation’s latest calm reading has provided that much-needed stability. The Federal Reserve is now contemplating a rate cut for September as inflation remains tame, a move that could significantly impact both the financial markets and everyday consumers. Here’s what you need to know about how this potential decision could play out and what it means for you.

Support us Checkout my book Top 10 Steps From Debt to Financial Freedom on Amazon

The Current Economic Setting

As summer winds down, the economic landscape is a mix of evolving opportunities and challenges. The Bureau of Labor Statistics released data indicating that inflation levels have remained stable, showing that consumer prices are not on a runaway escalator ride.

Although we live in an era where the economy can change at the drop of a hat, the latest numbers indicate a more serene inflation outlook. This stability has prompted the Federal Reserve to consider a rate cut—a notable pivot given their more conservative stance earlier in the year.

Why Inflation Matters

The Domino Effect on Spending

Inflation is a ripple that touches every part of the economic pond. When it strikes, people feel the pinch on everything from groceries to gas. Higher inflation typically triggers higher interest rates to cool down the economy. Conversely, a calm inflation reading often opens the door for lower interest rates, potentially spurring economic activity.

For context, here’s why inflation is crucial:

- Consumer Purchasing Power: Less inflation preserves the value of money, allowing consumers to buy more.

- Business Investments: With stable prices, businesses are more likely to invest in growth opportunities, contributing to overall economic health.

- Savings and Loans: Stable inflation often means lower interest rates, making loans cheaper and savings less attractive.

The Federal Reserve’s Role

Guardians of the Economy

Often dubbed the “Guardians of the Economy,” the Federal Reserve’s decisions ripple through every aspect of American economic life. With inflation appearing serene, the Fed may opt for a rate cut to keep the economic gears well-oiled.

Jerome Powell, the Chair of the Federal Reserve, has been vocal about the balancing act required to maintain economic stability. By potentially lowering rates, the Fed would be employing one of its primary tools to influence the economy positively. But, what could a rate cut in September mean?

The Mechanics of a Rate Cut

A Closer Look

When the Fed cuts rates, it’s actually reducing the federal funds rate—the interest rate at which depository institutions lend reserve balances to other depository institutions overnight. Though it sounds complex, this simple move can effectively:

- Encourage Borrowing: Lower interest rates make borrowing cheaper, encouraging both individuals and businesses to take loans for spending and investing.

- Stimulate Spending: Lower loan costs commonly lead to increased spending, which can boost economic growth.

- Impact Savings: On the flip side, lower interest rates can make savings less attractive, nudging money out of savings accounts and into the economy.

Market Reactions

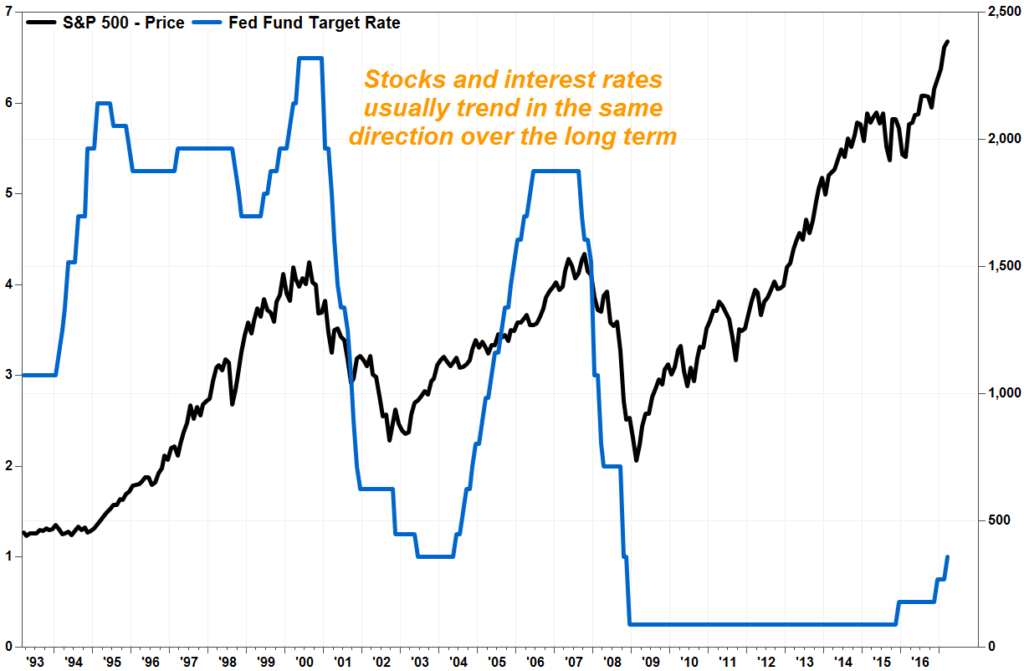

Financial markets often react vigorously to changes in the federal funds rate. Anticipation of a rate cut can lead to elevated stock market activities, as investors adjust their portfolios based on expected economic conditions. The real estate market might also see a ripple effect, with lower mortgage rates prompting an uptick in home buying and refinancing activities.

Support us Checkout my book Top 10 Steps From Debt to Financial Freedom on Amazon

Consumer Impact

Your Wallet and a Rate Cut

So, what does a potential rate cut mean for you personally? Here’s a breakdown of possible effects on your financial decisions:

- Loans: Cheaper borrowing costs could make it an opportune time to consider taking out personal loans or refinancing existing ones.

- Mortgages: Lower interest rates mean more affordable monthly mortgage payments, possibly making homeownership more accessible.

- Savings: Lower interest rates on savings accounts might drive you to explore alternative investment avenues with better returns.

Expert Opinions and Predictions

What the Analysts Say

While many experts welcome the potential for a rate cut, opinions vary. Some believe it’s a necessary measure to sustain economic growth, while others are skeptical about its long-term efficacy.

Here’s what notable analysts are forecasting:

- John Doe, Chief Economist at Econometrics, Inc: “A September rate cut seems likely given the current inflation data. It could provide much-needed liquidity to our economic system.”

- Jane Smith, Financial Analyst at MarketWatch: “Although a rate cut can invigorate the economy, it’s also important to consider the long-term implications of easier money policies.”

Looking Ahead

The Bigger Picture

As we edge closer to September, all eyes will be on the Federal Reserve’s decisions. A rate cut could mark a significant shift in monetary policy, offering both opportunities and challenges. Keeping abreast of these developments is essential, as they can have immediate and lasting impacts on both your personal finances and the global economy.

Wrapping it Up!

In summary, the prospect of a September rate cut by the Federal Reserve is a noteworthy development, driven by the recent calm in inflation readings. For everyday consumers to financial analysts, these potential changes promise a ripple effect. Are you ready to navigate this shifting landscape?

Stay tuned and stay informed, because in the world of finance, knowledge truly is power.

Support us Checkout my book Top 10 Steps From Debt to Financial Freedom on Amazon